[ad_1]

In previous years, outbound medical tourism from the UK has been pushed by sufferers looking for to economize by travelling for beauty surgical procedure and dental therapy in decrease price locations in Europe, similar to Hungary, Poland and Turkey. Has the affect of the pandemic expanded the outbound medical tourism market from the UK?

Previous to the pandemic, many hospitals, clinics and facilitators throughout Europe noticed the UK as a wealthy supply of medical vacationers, and regardless of a lot of the destructive publicity within the UK media, there was a gradual development within the variety of sufferers travelling for decrease price beauty surgical procedure and dental therapy, and to some extent for IVF. Estimating the variety of such medical vacationers has by no means been simple, regardless of the efforts of the Workplace of Nationwide Statistics to watch such exercise via the International Passenger Survey. Nevertheless, the small measurement of the information pattern, makes it troublesome to place an correct determine on the outbound movement. It might be 50,000. It might be 100,000. It might be extra, or a lot much less. No-one actually is aware of.

Because the pandemic, locations are reporting the restoration of medical tourism from the UK. Nevertheless, inflation, the present recession and the ensuing strain on disposable revenue might, in reality, limit the movement of sufferers for “discretionary” remedies similar to beauty and dental. However then again, has the pandemic pushed demand in different areas of healthcare?

To gauge this new demand, we have to take a look at how the pandemic has affected UK sufferers entry to well being providers.

How Covid-19 has impacted UK healthcare

The affect of the pandemic on NHS capability, the underfunding of public sector healthcare providers, and the extreme employees shortages (partially on account of Brexit – the variety of new nurse registrations from the EU has dropped by 87%), have meant a steep rise in ready lists and pent-up demand for healthcare. The principle drivers have been and proceed to be:

- Sufferers on ready lists for NHS therapy who would ordinarily have been seen by now.

- Sufferers who haven’t but introduced to their GP (main care doctor) to hunt a referral for signs attributable to considerations of burdening the well being service or fears round COVID-19 an infection.

- Sufferers who’ve had operations cancelled attributable to employees shortages.

- Sufferers who’ve had guide/specialist referrals delayed or cancelled.

- Sufferers who’ve had referrals refused attributable to an absence of capability.

- Sufferers who’re unable to safe immediate entry to main care providers, making a delay in preliminary analysis and referral.

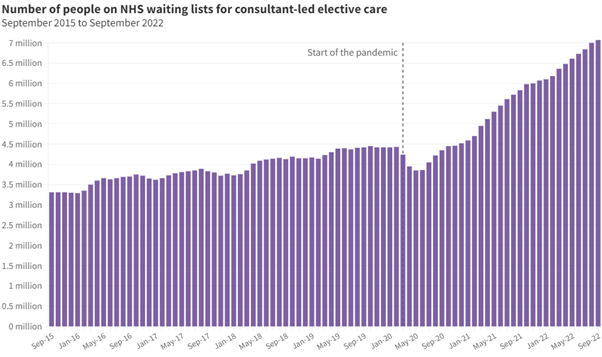

Previous to the pandemic in February 2020 there have been already 4.43 million sufferers on a ready listing for care in England. The most recent figures present:

- A file of seven.1 million folks ready for therapy on the finish of September.

- 87 million sufferers ready over 18 weeks for therapy.

- 401,537 sufferers ready over a yr for therapy – which is over 400 occasions the 1,032 folks ready over a yr pre-pandemic in July 2019.

- A median ready time for therapy of 14 weeks – considerably increased than the pre-COVID length.

Supply: BMA analysis of NHS England Consultant-led Referral to Treatment Waiting Times statistics

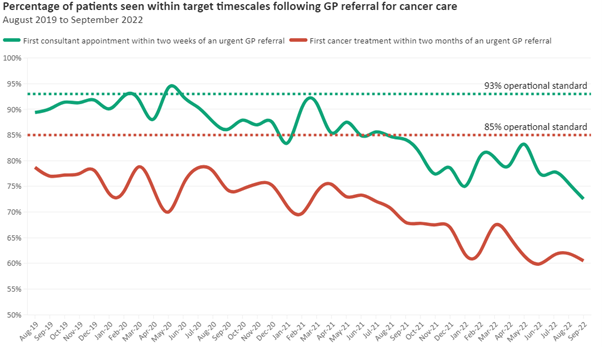

All areas of healthcare are being affected, together with severe ailments similar to most cancers and coronary heart illness which in regular occasions could be seen inside a two-week referral goal. The Office for Health Improvement and Disparities (OHID) stories that because the starting of September, there have been practically 900 extra deaths in folks with most cancers than could be anticipated at the moment of yr.

Right here is the image for most cancers referrals.

Supply: BMA analysis of NHS England Consultant-led Referral to Treatment Waiting Times statistics

The proportion of sufferers seen by a specialist guide inside two weeks of an pressing GP referral for suspected most cancers is extraordinarily low. The 93% goal for sufferers to be seen inside the two-week goal has not been met since Could 2020.

Some efforts have been made to outsource NHS sufferers for therapy within the UK’s non-public hospitals. Nevertheless, there are capability points within the non-public sector attributable to elevated demand within the self-pay market and the backlog of personal sector sufferers.

The expansion of self-pay therapy

Self-pay therapy is the place a affected person who is just not lined by medical insurance, decides to pay money (or take out a mortgage) for therapy in a personal hospital beneath a hard and fast value surgical procedure bundle. Typical costs for this from a significant UK supplier:

- Hip substitute – £12,500 (US$14,800)

- Knee substitute – £12,500

- Cataract surgical procedure – £2,650 (one eye)

In keeping with the Private Healthcare Information Network which gathers knowledge on non-public healthcare exercise, when evaluating July to September 2019 and the identical interval for 2021, there was a rise in self-pay of 35%, with 67,100 folks opting to pay out-of-pocket for personal therapy. Spire Healthcare reported a ‘sustained swap’ in client attitudes in direction of non-public hospital care and that personal affected person income was up by greater than 30% on pre-pandemic ranges. The transfer to self-pay additionally extends to these areas the place sufferers would usually count on immediate therapy beneath the NHS. The month-to-month variety of privately funded chemotherapy classes reached 13,200 in 2021, up from round 10,000 in February 2019.

So… what’s the alternative for locations to focus on the UK?

Up to now, few UK sufferers have chosen to go overseas for main surgical procedure. Nevertheless, the present state of the UK’s well being providers might encourage UK sufferers to increase their horizons when it comes to remedies that they search and the locations that they might take into account.

That represents a possibility for businesses and facilitators, and hospitals and clinics in decrease price locations that may reassure UK sufferers concerning the high quality of care and therapy end result. Should you’re this enterprise alternative, listed here are some issues to contemplate:

- Worth – how do your costs examine to these inside the UK’s non-public hospitals when the price of journey and lodging are factored in?

- Have you ever thought of offering finance/mortgage preparations for sufferers?

- Are you able to provide an all-inclusive, fastened value bundle that matches the providing of a UK non-public hospital?

- High quality – are you able to present proof of your requirements of care and importantly… outcomes?

- Affected person help – how will you help the affected person all through the affected person journey, notably after they return house.

And at last, how will you generate enquiries and entice these UK sufferers? Be sure you embrace LaingBuisson’s affected person acquisition website, Treatment Abroad in your advertising plans!

[ad_2]

Source link